Currency Online Trading

Spread Betting

CurrencyOnline Trading: Financial Spread Betting has grown in popularity in recent years, not least because it is tax free in many countries. Spread Betting is leveraged and like other financial derivatives it gives investors the opportunity to gain exposure to markets without having to buy the underlying asset. This means that the trader/investor can speculate in the direction of any financial instrument, whether it is Stocks, Exchange Traded Funds, Forex, Commodities or Bonds.

Spread Betting is targeted at smaller retail traders. Large financial players in the market such as banks, corporations, mutual funds etc. wouldn’t be in the Spread Betting market. However, that doesn’t mean it isn’t possible to make large profits (or losses) through Spread Betting.

Many markets have standard contract sizes but with spread betting, the investor nominates his own stake size. For example, a trader of the Dow Jones Futures Contract would have to pay $10 per point. With a spread betting account, however, you can choose the size of your stake, e.g. $1 per point. This enables small investors to gain access to markets they would otherwise be unable to afford. The flexibility of setting your own stake allows greater control over your risk. The bet is settled as the difference between the purchase and the sale price. Spread Betting also allows short trading so traders can profit from rising or falling markets.

The trader is not participating in the “real” market. It is not the real stock or futures exchange where the best bid/offer prices are on display. Rather the Spread Betting Company acts like a bookie and provides a trading platform that tracks the real market. The company sets the spread, which is the difference between the bid and offer price. That is the main way they make their money. They also make money through other means such as financing charges and currency exchanges.

For example, the Dow Jones is trading at 10000. The asking price is 10004 and the selling price is 9996 giving an 8 point spread. Trader A places a €1 per point bet at 10004 in the expectation that it will rise. Trader B sells a €1 per point bet at 9996 in the expectation that it will fall. The Dow closes at 10100. Trader A exits the trade for a profit of €96. Trader B exits at the same price and loses €104. The company gets €8. In real life it’s not often that the spread betting company will have another trader to be the counterparty but if you have thousands of trades per day, the net effect will produce earnings for the company. Bigger companies can hedge their risk by owning the underlying asset or if they have a big enough book they will be able to hedge the trades internally.

LEVERAGE

One of the great benefits and risks ofCurrency online trading with spread betting is leverage. However, leverage magnifies both gains and losses. Many investors enter the market by buying stocks for which they pay the full amount. If they buy €5000 worth of stocks they must have the full cash amount plus any other fees and charges. With leverage, however, a trader can gain exposure to the movement of an underlying asset with less money. This amount, known as initial margin, is like a “good faith” deposit to ensure any potential losses are covered. Deposits and margin requirements may differ depending on the market.

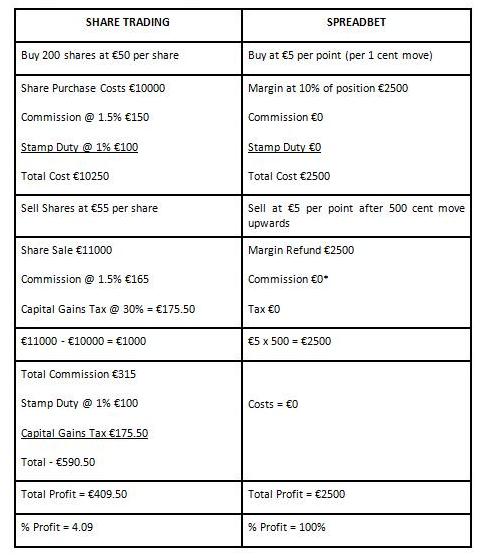

Following is an example of the power of spread betting with shares.

Currency Online Trading

*While there is no commission investors should be aware of an inherent cost inCurrency online trading with spread betting which is the spread. The price you buy or sell at will be above or below the actual market price.

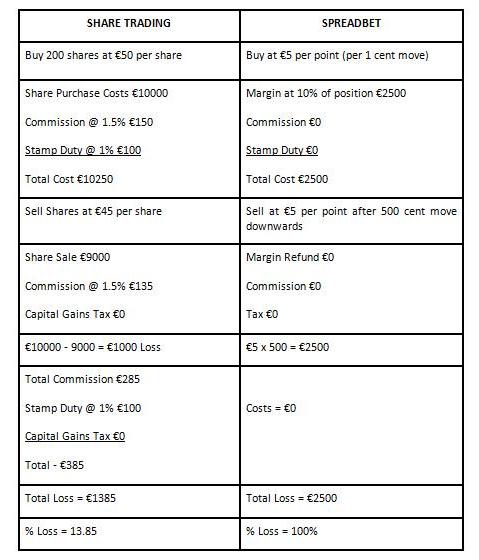

The advantage of trading using leverage is clearly demonstrated using this example. However there is a downside and it’s a big one. Let’s examine the results if the position went against you and the price of the share dropped by €5.

Currency Online Trading

You never ever want to be in a

position where you could lose 100% of your capital. In reality, the broker or

firm with whom you trade would contact you before you get to a 100% loss to

demand more margin (the dreaded margin call) to cover the losing position.

However, if you meet the margin call and refund your account, there is no

guarantee the market will turn back in your favour and the losses could

increase even further. The power of leverage works both ways and learning to

manage winning and losing positions is essential.

Spreadbetting has many advantages and can be used very effectively to develop a trading strategy. As in everything to do with trading, however, gain an understanding and

trade small until you get the experience. Traders may make use of Fundamental Analysis, Technical Analysis Indicators and/or Chart Patterns to aid their decision making.

Currency Online Trading: Spread Betting