Contracts For Difference

Contracts for Difference (CFDs) are a contract between two parties to exchange the difference between the opening and closing price of the underlying financial instrument. CFDs are a popular method used to gain exposure to the price movement of Shares, ETFs, Forex, Commodities and Bonds.

Investors/traders use Contracts for Difference for many reasons.

- CFDs provide exposure to the price movement of the underlying asset without having to take ownership of it. The CFD tracks the underlying price of the asset.

- Traders/investors expecting a rise in prices can buy (go long) or sell (go short) if anticipating a decline in prices. They provide the opportunity to profit in a falling market.

- CFDs can be more cost effective because they are leveraged. The investor is only required to put up part of the value of the investment, often less than 10%. This is similar to the margin required on a futures trade, however, unlike a futures contract CFDs do not have an expiry date.

- Stamp duty is not collected on a CFD trade because there is no transfer of ownership. Stamp duty is a tax on the change in legal ownership of shares.

- CFDs can be used to hedge an investor’s portfolio. For example, if an investor expects a temporary decline in the value of his/her portfolio, they could sell an equivalent value of CFDs. Any fall in value of the portfolio would be offset by the increase in value of the CFD position.

- CFDs allow an investor exposure to thousands of different assets including overseas markets.

- The trading hours for CFDs are longer than those on a local stock exchange. Many CFDs can be traded 24 hours a day which allows investors more flexibility.

- Online brokers provide easy access to the CFD market.

Providers of Contracts for Difference make their money in different ways depending on the broker. One is the spread which is the difference between the bid (lower price) and asking price (higher price). Let’s say a share is trading at $10. A trader may have to pay $10.05 to buy a CFD of this share or pay $9.95 to sell a CFD so the spread is 10 cents. Spreads will vary between brokers and assets.

Some brokers charge commission. For example, an investor enters a long position based on the value of shares at $10,000. A broker charging commission at 0.2% would receive $20. The commission applies when entering and exiting the trade. Some brokers advertise that they are commission free but typically have a larger spread to make up for it.

As stated before, unlike futures contracts, Contracts for Difference do not have an expiry date. However, they do charge a daily interest rate for positions held overnight. This is one reason why CFDs tend to be held on a shorter term basis i.e. days, weeks or perhaps a couple of months. On a short term basis the interest rate change may not make a material difference to an investor’s profits. However, the interest rate charge on a long term position may prove prohibitive.

Investors should confirm the rate of interest with their broker. Typically it is a rate linked to the London Interbank Offered Rate (LIBOR). LIBOR is a global benchmark used to determine short-term interest rates. For example LIBOR may be trading at 0.5% on a given day and the broker may apply a charge of 1% above LIBOR. Interest is paid by the investor on a long position but is received by the investor on a short position.

Dividends are also reflected in the financing of a CFD. Long positions will receive a dividend payment if due while short positions will pay a dividend if due.

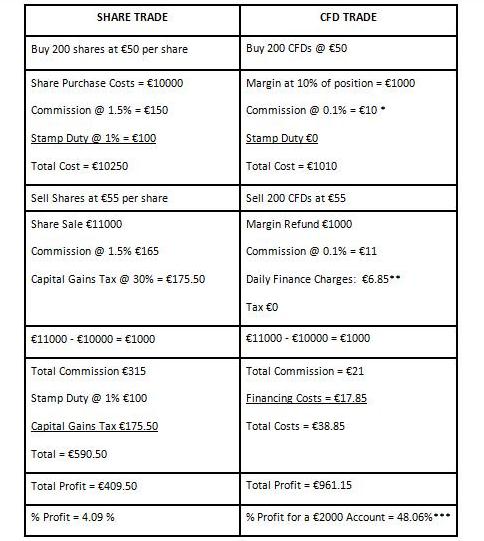

Below is an example of a CFD trade held for ten days in comparison to a share trade.

*CFD commissions tend to be lower than commissions on share trades.

** Daily interest charge: (€10,000 x (0.5% + 2%)/365 = €0.6849. Total interest charge = €0.6849 x 10 days = €6.85

*** The percentage profit depends on the size of the customers CFD trading account. The account needs to cover at least the margin, commission and financing costs (€1038.85). In reality the account should be larger to cushion against adverse movements and avoid margin calls. Even if the account was equivalent to the €10,250 required to enter the share trade the percentage profit would be better at 9.38%.

The main difference between Contracts for Difference and Spread Betting is that the latter is tax free. Differences may also arise with regard to the financing of positions. Spread Betting may charge a wider spread when trading shares while CFD’s may charge a commission. Some CFD providers, however, choose to charge a spread in particular in relation to indices, currencies and commodities. With Spread Betting the customer enters a ‘stake’ per point. In CFD’s you choose the number of them you wish to buy or sell.

Contracts for Difference are a very versatile financial instrument and traders can gain high leverage through using them. Leverage can magnify profits but also losses so it is important to apply effective risk management to CFD trades. Traders often use Fundamental Analysis, Technical Analysis Indicators and Chart Patterns to aid decision making.

Return to Top of Contracts for Difference