Options Trading

Options Trading: Options are tremendously useful and versatile financial instruments. This page is only an introduction to options trading which can be a little more challenging to understand than other financial products.

The principles behind options are not new. A type of option was mentioned by Aristotle in his writings as far back as 332B.C. He wrote of a man called Thales of Miletus who was one of the seven sages of Greece. Through his studies, Thales came to the conclusion that a huge olive harvest was due. Thales did not have enough money to buy olive presses so he placed a deposit to allow him to have control over the operation of the local olive presses. Thales was right. When the bumper harvest came in he sold the rights to use the presses to people who needed them and made a fortune in the process. Although not an option in the modern sense the principle was similar. The first modern financial options market was the Chicago Board Options Exchange. Established in 1973, it is the largest options exchange in the world.

Options are a financial derivative. The purchaser of an option has the right, but not the obligation to buy or sell a specific quantity of an underlying asset at a specified price (the strike or exercise price) by a specified date in the future. The purchaser pays a premium or fee for this right.

- A call option gives the purchaser the option to buy the underlying asset at the strike price. A call option is a bullish position. The buyer believes the underlying asset will rise in price.

- A put option gives the purchaser the option to sell the underlying asset at the strike price. A put option is a bearish position. The buyer believes the underlying asset to will fall in price.

The purchaser of an option pays a premium and the seller receives this premium. This article focuses on options trading on Stocks but they can also be traded on other financial assets including Stock Indices, ETFs, Commodities, Currencies and Bonds.

A stock option is typically based on 100 shares of a company. Let’s say the shares of company ABC is trading at $40 and an investor places an order to Buy ABC June 40 Call Option at $4.00. What does this actually mean?

- Buy: The investor is purchasing a call option. It is a bullish investment because the investor hopes the stock will rise in price.

- ABC: The name of the company or underlying asset.

- June: This is the month the option expires. On the Chicago Board Options Exchange, the expiry date is the third Friday of the month. In fact it’s the Saturday but the last trade date is on Friday.

- 40: This is the strike or exercise price. It means that the investor will have the right to buy 100 share of ABC at a price of $40.

- $4.00: This is cost of the option per share. The premium on this option, therefore, is $400 (100 shares x $4.00)

Why would an investor buy a call option? One reason is that it can be very cost effective because of the leverage. The investor may be of the view that the share price will rise from $40 to $45. Buying 100 shares outright would cost $4000 (100 x $40). If the investor is correct and the share rises to $45 they make a profit of $500 (100 x $5), a return of 12.5% on the investment. The option buyer, on the other hand, gains access to leverage because they only have to pay $400 or 10% of the value of the asset to enter the position. When the stock rises to $45 the option buyer can exercise their right to buy the shares at $40 and then sell them at $45. This also produces a profit of $100 ($500 profit - $400 premium), giving a return of 25% on capital employed.

Another good reason for options trading is that the risk is limited. Even if the share collapsed in value the minute the option was purchased the investor only loses the premium of $400. If they had bought the shares outright they stand to lose a lot more. Furthermore, the investor is tying up a lot more cash and the opportunity cost in buying the shares outright.

American options can be exercised at any time up to expiration date. Options are continually being bought and sold on the exchange. An option may increase in value before expiration and the buyer may choose to sell the option on the exchange for a profit. European options differ from American options in that they can only be exercised on expiration date.

Terms you will hear in options trading are In the Money, At The Money and Out Of The Money.

These terms refer to the strike price relative to the share price. The option does not have to be bought at the price the stock is trading at currently. An investor may choose a strike price that is lower or higher than the current stock price

Call Option

- In the Money: The stock is trading above the strike price.

- At the Money: The stock is trading at or close to the strike price.

- Out of the Money: The stock is trading below the strike price.

Put Option

- In the Money: The stock is trading below the strike price.

- At the Money: The stock is trading at or close to the strike price.

- Out of the Money: The stock is trading below the strike price.

The value of the option will vary depending on whether it is In The Money, At The Money or Out of the Money.

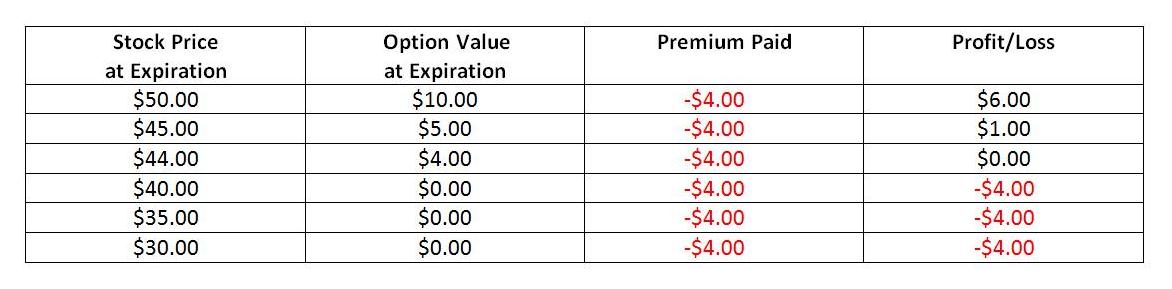

Let’s explore an example of a call option. ABC is trading at $43.00 per share. An investor buys an ABC June $40 Call Option at $4.00. This option is $3.00 In The Money ($43.00 - $40.00). The premium paid is $400 (100 shares x $4.00).

Options Trading Call Option

Options Trading Call Option

The breakeven price is $44.00 because the option cost $4.00. If the share price is below this the option expires worthless and the investor loses no more than the premium.

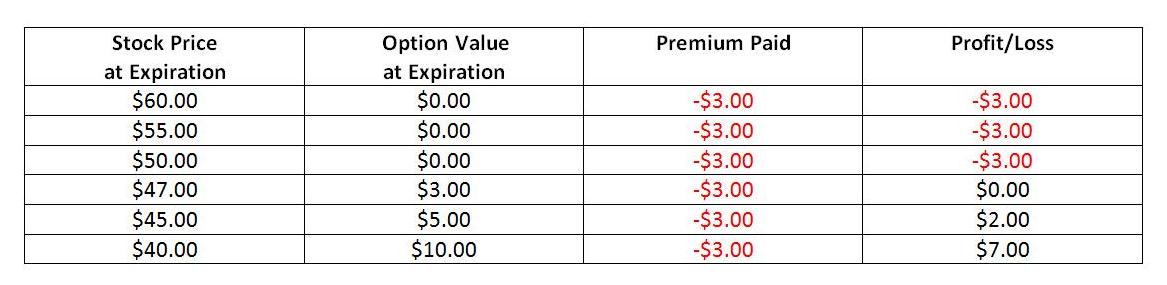

Following is an example of a put option. ABC stock is trading at $50.00 and the investor chooses to buy an ABC April 50 Put at $3.00. The investor now has the right to sell the shares at $50. The strike price is At The Money and the cost of the option is $300 (100 shares x $3.00). If the stock declines to $40.00 they can sell the shares at $50 and buy them back to return them at $40 for a profit of $7.00 per share ($10.00 - $3.00).

Options Trading Put Option

Options Trading Put Option

The breakeven point is $47.00 because the option cost $3.00. If the share price is above this then the option expires worthless.

Of course option sellers want the option to expire worthless because they keep the premium.

In options trading it is probably wise to concentrate on a few stocks or assets that an investor is very familiar with. Choosing the strike price needs to be realistic. There’s little point in buying a 3 month call option with a strike price of $100 on a stock trading at $50. It’s a highly unlikely outcome. An investor/trader who knows their stock well will be in a better position to choose a strike price that is reasonable. A reasonable strike price is one that the underlying stock has a decent chance of reaching within the specified time frame. Although there are no guarantees how a stock will behave, it is only by studying stock price behaviour over time that the investor can make an informed decision.

The pricing of options is a challenging topic which requires further study for investors who want to engage in options trading. There are a lot more variables involved for an option trader than a stock trader. When you buy a share and have a target price at which to sell it, it’s easy to calculate the potential profit. I buy 1000 shares at $10 with a price target of $13.00. I know in advance that my profit will be $3000 if I’m right (1000 shares x $3.00). Options, however, are not so simple.

Factors that affect option prices are known as the Greeks. An in depth discussion of the Greeks is not within the scope of this article but it is important to be aware of them. The five Greeks are Delta, Gamma, Theta, Vega and Rho. It is not necessary to know the complicated mathematical formulae that are used to calculate the Greeks. However, it is important to know how they affect the value of an option.

- Delta is a measure of the rate of change in an option’s price for a $1 move in the underlying stock. For example, if the delta on an option is 0.3 and the share price rises by $1 then the option would rise by 0.30 cent per share or $30 per option contract

- Gamma is the measure rate of change of an option’s delta due to a change in the stock price.

- Theta measures how much the theoretical value of an option decreases over time all other factors remaining equal. Time decay means that the time value element of an option is decreasing each day it gets closer to expiry.

- Vega measures the change in value of an option with a change in implied volatility of the stock. Volatility rises when traders are fearful and falls when they are confident and bullish. Option premiums increase in value with higher volatility and decrease with declining volatility.

- Rho measures the sensitivity of a stock option's price to a change in interest rates.

Options do take a bit of work to understand but it is possible to practice option trading by paper trading them with an online broker. This a valuable exercise because you can get a feel for how they behave in different circumstances. As was stated already, options are advantageous due to the leverage gained and limited risk. Options are also very popular because they are extremely versatile investment instruments. The ability to buy calls and puts is attractive in itself but investors can employ far more sophisticated strategies if so desired. An option trading strategy exists for every possible view of the market and this versatility makes them very attractive for investors. Option traders may use Fundamental Analysis, Technical Analysis Indicators and/or Chart Patterns to aid their decision making.

Return to Top of Options Trading