Risk Management

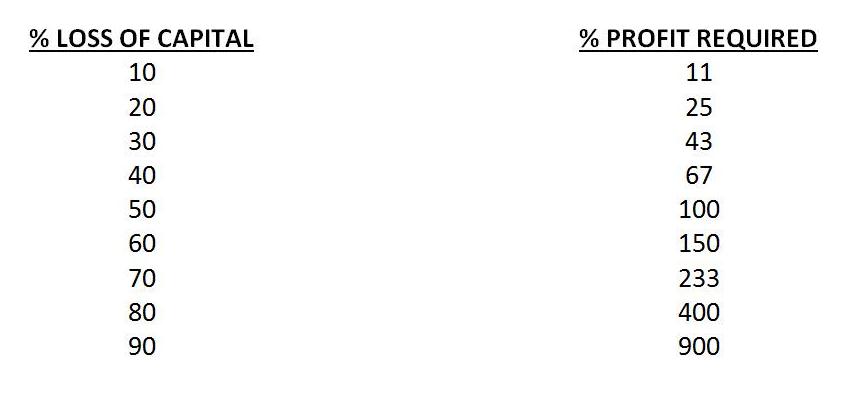

Risk management is perhaps the most important part of trading. Traders can spend a lot of time researching or investing in the perfect trading system that will set them on the road to riches. No system exists, however, that doesn’t produce losses and if it did, who would publicise such a holy grail. Regardless of your skill level or the effectiveness of your system, it will all come to nought unless it is accompanied by appropriate rules of risk management. This section will explore concepts behind effective money and risk management. The table below is worth imprinting in memory.

Risk Management in Trading

The table shows the percentage profit required to bring your trading balance back to break even following losses. If you lose 10% of your capital you have to make 11% profit on your remaining capital just to get back to the initial balance. If you lose 20% you have to make 25% and so on. It’s just not going to happen. Berkshire Hathaway, founded by legendary investor Warren Buffet, averaged an annual growth in book value of 20.3% to its shareholders for over 40 years. Soros Fund Management, founded by George Soros, known as the man who ‘broke the Bank of England’ returned an average of 20% over four decades.

The HFRI Fund Weighted Composite Index is a global, equal-weighted index of over 2,000 single-manager funds. In 2011, the worst performing decile declined by 30.7%. The top decile gained 19.5 per cent. The composite result was a decline of 5.6%, (Source: Hedge Fund Research, Inc.). Granted, 2011 was a very challenging year for traders but if these are the results that professionals produced it should give us pause for thought. Novice traders often drop 10%, 20% or 30% of their account and think they can make up for the losses as quickly as they lost it. Typically they engage in overtrading to try and “catch up” quickly and end up in an even worse financial position.

Risk/Reward Ratio:

Risk/Reward ratio is used by traders and investors to calculate the return on an investment relative to the risk. For example, a trader opens a long position and places a stop loss order below the entry price. The trader has calculated that if the market moves against them and the stop loss is triggered they will lose $1000. On the other hand, if the trade is profitable and reaches the exit target, the potential profit is $3000. In this scenario the trade has a risk:reward ratio of 3:1. They are risking $1000 for a potential gain of $3000. It is a convention amongst traders to refer to the risk/reward ratio even though the potential reward is quoted first.

Win/Loss Ratio:

Win/Loss ratio is a ratio of the total number of winning trades to the total number of losing trades. Let’s say a trading system on average produces 25 trades per annum. 10 are winners and 15 are losers which is a win/loss ratio of 2:3. This helps a trader plan their money management. Of course, it’s not guaranteed but they have a reasonable expectation that approximately 40% of their trades will be profitable. However, you can never be sure which 40% of trades will be the winners. An attractive win/loss ratio does not guarantee profits because results can depend on the percentage capital risked per trade and the order of successful trades.

Consider a trading system that on average generates:

- One trade per week

- Win/loss ratio of 2:3 (40% of trades are profitable)

- Risk/Reward ratio of 4:1

- 5% of capital risked on every trade

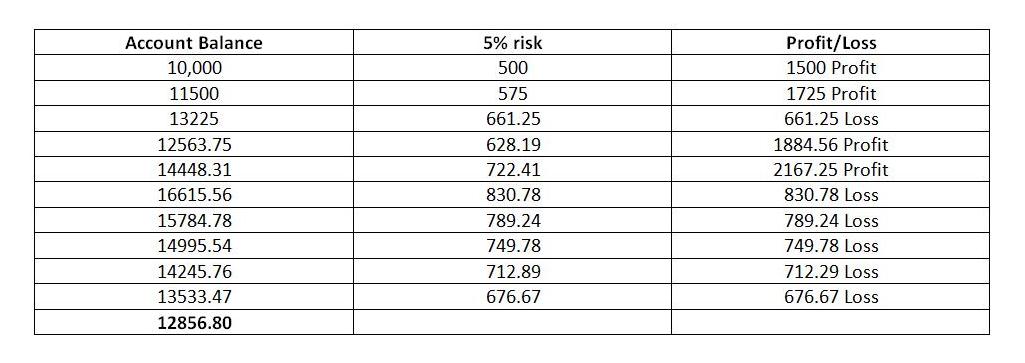

The following table shows the results after 10 weeks trading a $10,000 account.

Risk Management in Trading

A 28.57% profit (2856.80/10000 x 100) after ten trades would keep most traders content. Now examine the results of a trading system that on average generates:

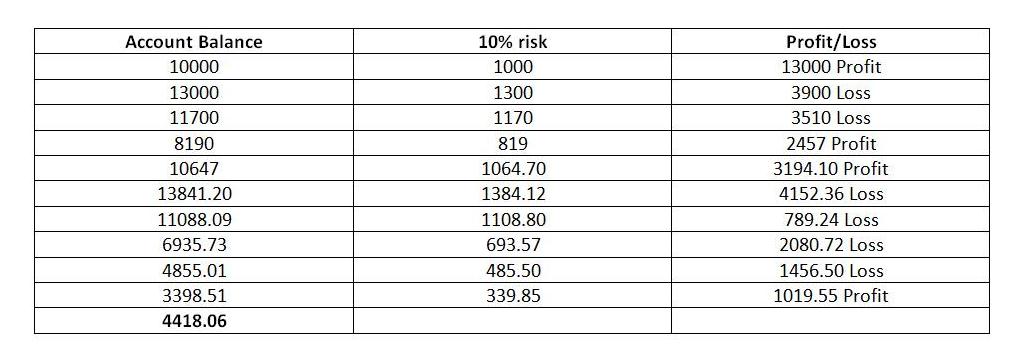

- One trade per week

- Win/loss ratio of 2:3 (40% of trades are profitable)

- Risk/Reward ratio of 4:1

- 10% of capital risked on every trade

Risk Management in Trading

This approach resulted in a loss of 5581.94 or 55.82% of the account and probably a long time on the side-lines. This exercise is not an attempt to fiddle the figures to prove a point. Both trading approaches have a win/loss ratio of 2:3 and a considerable amount of research may have gone into developing these systems. However, we cannot be sure when the winning trades will come and the percentage of capital risked has a huge effect on the outcome.

How much should I risk per trade?

As you can see the answer to this question is not straight forward. It depends on a number of factors but important considerations are:

- Number of trades the system generates

- Win/loss ratio

- Risk/reward ratio

- Percentage of capital risked per trade

In general, the more frequently you trade the smaller the percentage capital should be risked on each trade. Frequent trading means that there is a greater chance of a string of losses in a shorter period of time. The win/loss ratio should give a good indication of how many losses in a row the system may produce. The risk/reward ratio will give a good indication of the potential profit from the winning trades. This has to be greater than the total losses. A reasonable risk reward ratio would be in the 3:1 or 4:1 region. Consider that a 1:1 risk/reward ratio requires that, at a minimum, over 50% of trades are winners.

In conclusion, if you’re just starting out trading it would be wise to only risk a small amount of your capital until your skills and confidence develop. Many professional traders won’t risk more than to 2% or 3% of their capital on a trade. As a general guideline, your account should be able to handle the potential number of losing trades in a row inherent in your trading strategy. The drawdown should not be so significant that you cannot trade due either to the resulting damage to your financial capital or psychological capital i.e. loss of confidence in the system or your abilities. For active trading it is wise is to start small and as your trading account increases so too can the percentage capital risked on each trade. Knowledge of Fundamental Analysis, Technical Analysis Indicators and/or Chart Patterns can help to implement effective money management strategies.

Return to Top of Risk Management