Trading Order Types

Trading Order Types: One of the cardinal rules of trading is to use stops. Stops are an important part of risk management and trading strategy. They are a way of managing trades and preventing a catastrophic loss of money. However, traders have a love/hate relationship with certain types of stops. This will be discussed later. First we will cover the different order types. These are explained using stocks as an example but can be applied Exchange Traded Funds, Forex, Commodities, Bonds, Futures etc.

Trading Order Types - Market Order

An order to buy or sell at the best available price. If you’re trading online the bid and ask price will be displayed live on screen. If you ring a broker they will quote the price to you. This order is for someone who wants to enter or exit a position immediately. For example, ABC shares are trading at $10. A market order could be to “Buy 1000 ABC shares at market” or “Sell 1000 ABC shares at market”. The broker will give you the best available price there and then. Note that in a fast moving market that you may not get the exact price you want.

Trading Order Types - Limit Order

An order to buy or sell at a specific price or better. A buy limit order is executed at the limit price or lower. A sell limit order is executed at the limit price or higher. The market has to reach the limit price for the order to be initiated.

If ABC stock is trading at $11, an investor may decide to place a limit order to buy 1000 ABC shares at $10. If the market declines to $10 the order is initiated. However, it may be executed at a lower price. If the market gaps below $10 to $9.90 then the order will be executed at that price.

If ABC stock is trading at $19, an investor may decide to place a limit order to sell 1000 ABC shares at $20. If the market advances to $20 the orders initiated. Once again, it may be executed at a higher price. If the market gaps above the limit price to $20.50 they may get it at that price.

Why would a trader/investor use this order? A share is trading at $11. An investor believes that the share price of the company will rise. However, they believe it will decline to $10 before it begins to rise. They may enter a limit order to buy the share at $10 because it will be better value. Of course, there is a risk that the share does rise in price but doesn’t trade down to the limit price. In this case the investor has missed the boat and may have to buy the shares at a higher price.

Another way to use a limit order is if an investor owns the shares of a company and wants to sell them. The shares are trading at $19. The investor believes that the market will rise to $20 so they enter a limit order to sell 1000 shares at $20. Once again there is a risk that the market may not reach $20 and the investor ends up selling at a lower price.

Trading Order Types - Stop Loss Order

An order to buy or sell a stock once the price of the stock reaches a specified price. A stop order becomes a market order when the specified price is hit. Investors often use stop orders to limit losses. A buy stop order is entered at a specified price above the current market price. A sell stop order is placed below the current price.

For example, an investor owns 1000 ABC shares trading at $12 per share. If the share price declines to $10 the investor wants to sell the shares. They will place a stop order to sell 1000 ABC shares at $10. Alternatively, an investor may have sold 1000 ABC shares short at $19. A decline in prices will result in a profit and a rise in prices will result in a loss. They may enter a stop loss order to buy 1000 ABC shares at $20 in order to limit their losses.

Stop orders may not be executed at the specified price. As stated before, a stop order becomes a market order when the specified price is hit. However, if the market is moving fast or gaps there can be some slippage. Slippage occurs when there is a difference between the price specified in the order to the actual price at which it is executed. It can occur during periods of high volatility. Some brokers offer guaranteed stops but typically you will pay a premium for this service.

A stop order can also be used to enter a trade. For example, ABC shares are trading at $10 which has proved a major resistance level in the past. The investor believes that if the shares can break through this resistance level that the shares will move significantly higher. They could place a stop order to buy 1000 shares at $11. Alternatively, an investor may wish to enter a short position. Shares are trading at $20 which has being a major support level in the past. If the $20 level is broken the investor believes the share price will decline significantly. They can enter a stop order to sell 1000 shares at $19.

Trading Order Types - Stop Limit Order

An order that combines a stop order and limit order. When the stop order is hit it becomes a limit order that will be executed at a specified price or better. This order gives more control to the investor over the execution price.

For example, ABC shares are trading at $49. An investor believes that the market will probably rise but wants to wait for some further confirmation to the upside before buying. They may enter a stop-limit order to buy 100 ABC shares at $50 limit $51. If the shares rise to $50, the shares will be bought but not at a price above $51. The investor, therefore, has control over when the order is filled and can set a maximum amount they wish to pay. However, there is no guarantee that the order will be filled. The shares may not reach the $50 price. Furthermore, a volatile and fast moving market may hit the stop price but move rapidly above the limit price. In this case the order won’t be filled. Stop limit orders can also be used to enter a short position.

Trading Order Types -Trailing Stop

A stop that is set at a number of points or percentage below the market for an investor that has a long position. For an investor with a short position, it is a stop set at a number of points or percentage above the market.

For example, an investor owns shares that are trading at $20 per share. They could enter a trailing stop loss order at $2 below the market. If the market rises to $21 the stop rises to $19. If it goes to $22 the stop moves to $20. If the market now declines to $21 the stop remains at $20 and will remain there until it is filled. Otherwise the market will continue to rise and the stop will trail it. Alternatively, the investor may wish to set the stop a certain percentage away from the current market price. A similar strategy can be adopted by an investor in a short position.

Trading Order Types - Day Orders

An order will typically be treated as a day order unless the investor says otherwise. The order will lapse at the end of the day if it is not executed.

Trading Order Types - Good Till Cancelled Order (GTC)

An order that stays in the market until it is filled or the investor cancels it.

Trading Order Types - Fill or Kill Order (FOK)

The entire buy or sell order must be executed or not at all. No partial orders are acceptable. For example, ABC shares are trading at $10. An investor wishes to buy 1000 ABC shares at that price but only if the broker can execute the whole order. They don’t want to buy 500 shares at $10 and the other 500 at $10.50.

Trading Order Types - All or None Orders (AON)

It is similar to a fill or kill order. A fill or kill order will be cancelled unless it can be executed immediately. An AON order can remain open until it is filled.

Trading Order Types – One Cancels the Other (OCO)

Two linked orders. If one order is executed then the other is cancelled.

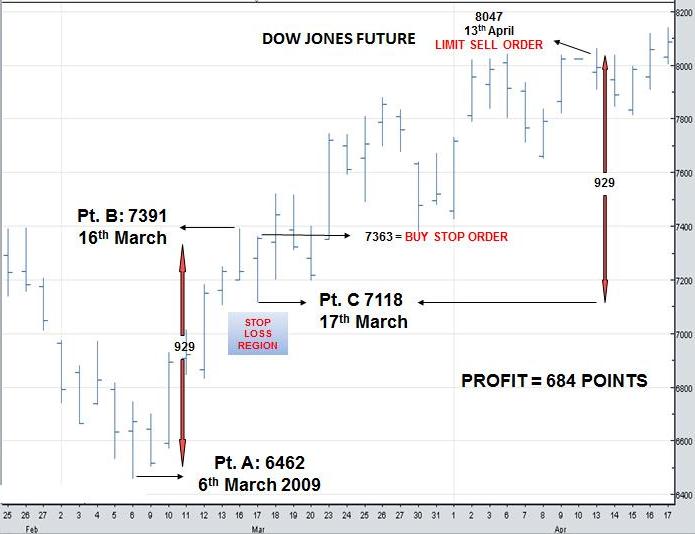

The order types a trader employs will differ depending on their strategy. Below is a basic graphical example of how a trader might use stops. It is based on a Spread Betting chart of the Dow Jones Futures Contract. Read the page on Measured Moves for a more detailed explanation of this trading strategy.

Trading Order Types

Trading Order Types

The trader anticipates that the market will advance higher if it can break above the high of the daily bar made on 17th March. They enter an order to buy at 7363 on stop. The order is filled the next day so they place a stop loss order somewhere below the lowest price traded on the 17th March. The price at which they place the stop depends on the level of risk they wish to take. As the market advances they may move the stop loss higher. As the market approaches the target price of 8047, the trader places an order to sell at a limit of 8047. When the market hits this price the sell order will initiate and execute at the best price available.

As stated before, traders have a love/hate relationship with some trading order types, in particular stop loss orders. Regardless of whether they trade financial markets, human beings hate realising a loss. Furthermore, traders are frequently stopped out of positions only to have the market reverse direction and go back in the direction the trader had initially bet. In this scenario, the trader has not just realised a loss but watches as the trade goes on to make what would have been a great profit. This drives traders crazy.

The temptation, therefore, is not to use stop losses. The problem with this is that the trader is exposed to a catastrophic loss of money. A major market moving event can occur caused by man or nature and the result is total destruction of capital. W.D. Gann, a legendary trader on Wall Street in the last century described it as “amputation without anaesthetic” – not an attractive proposition.

Some traders cope with market volatility by operating a time stop. For example, they have a long position and decide to exit at a loss only after three consecutive days of decline. Alternatively a trader may enter a stop loss so far away from the market that it would need something major to happen for the market to hit it. However, they have decided a price at which they will get out that is much closer to the current market price. This type of trader needs a very disciplined trading psychology. A stop loss order entered into a computer will execute automatically. By having a “mental” stop the trader avoids getting hit by day to day volatility but must be able to hit the exit button when the market hits their “mental” stop. The temptation will always be there to leave the trade open just that little bit longer because you “think” the direction will change back in your favour. Furthermore, if a major market event does happen they stand to lose a lot of money because the “far away” stop loss could be hit. They may not lose everything but it will certainly be painful.

In conclusion, stop strategy is a vital part of trading and traders should become familiar with the different order types. Traders/investors often use technical analysis indicators and chart patterns when developing a stop strategy. Markets are volatile so if stop loss orders are too close to the market they will always get hit. If they are too far away the risk of losses is greater. Finding the correct balance is a challenge. With experience, however, traders get a feel for where stops should be placed. All they can do then is wait for the market to make its move.

You should always confirm your order with your broker. Double check that the order matches what you wish to accomplish before you ring them. Do the same when trading online. Get the broker to repeat the order back to you to ensure that there is no misunderstanding. It is also important to be aware of a broker’s policies regarding orders as they can differ slightly from one to another. Furthermore, clarify the terminology that they use for each type of order as this can also vary slightly.

Return to Top of Trading Order Types